Compute gross profit on the sale of Job 201. Total revenue - COGS Total revenue x 100 Gross profit margin.

Solved A Purchased 100 800 Of Raw Materials On Credit B Chegg Com

For example lets say you sell an item for 200 and it cost you 180 to get it.

. 10 percent of 200 is 20. Simply put profit is the amount of money you make on a sale after you subtract the cost of acquiring or producing the product. You sold it for 200 you made 20.

Cost of raw materials purchased 101700 Job 201 Job 202 Total Direct materials 49900 25300 75200 Direct labor 40900 14300 55200 Overhead applied 39920 20240 60160 Total costs 130720 59840 190560 Sales 168860 Gross profit 38140. If it is low it means that the firm concerned does not have a safe ground for its operations. 12500 If you sell 200.

Gross Profit Sales Purchases Direct Expenses. 6250 If you sell 75 units you would make. Required 1 Required 2 Compute gross profit on the sale of Job 201.

Cycle Wholesaling uses a perpetual inventory system and it allows returns only within 15 days of the. Job cost sheet is a document used to record manufacturing costs and is prepared by companies that use job-order costing system to compute and allocate costs to products and services. Kyle Taylor Founder at The Penny Hoarder 2010-present.

For example if you made 200 on installing mini-blinds in a home and your cost to do the job was 150 then divide 200 by 150 to arrive at 133333. Calculate gross profit and cost of goods sold from the following information. Thus the formula for calculating Gross Profit is as follows.

Prepare journal entries to record the transactions reflected in items a through g. Each of T-accounts started the month with a zero balance. To what extent revenues cover their immediately related costs is revealed by this ratio.

Divide the income received for the job by the total cost of the job. Compute gross profit on the sale of Job 201. In the case of Garrys Glasses the calculation would be.

Still you wouldnt take home the entire 880 in profit at the end of the day. Gross Profit Margin Revenue - Cost of Goods SoldRevenue x 100. In this case youll have a 10 percent margin on that sale.

Compute gross profit on the sale of Job 201. Gross Profit 25 on Cost. Post entries for transactions a through g to the T-accounts.

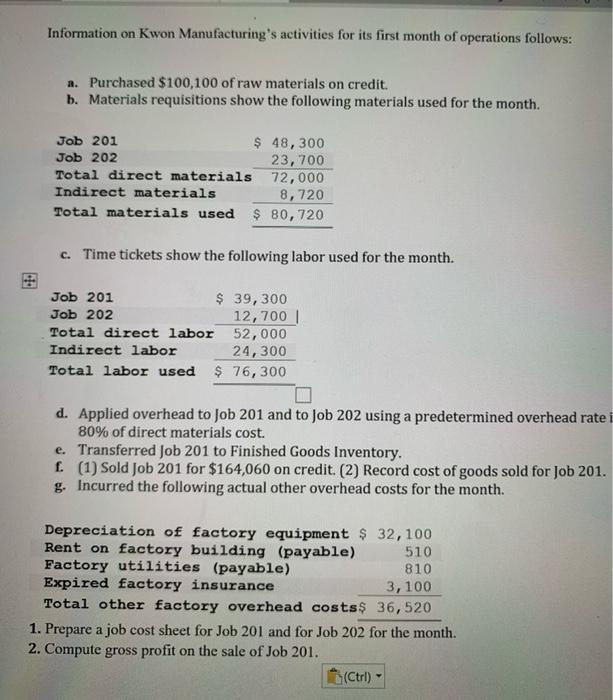

Prepare a job cost sheet for Job 201 and for Job 202 for the month. Identify the formula and then compute the gross profit. Compute gross profit on the sale of Job 201.

On February 9 Sarahs Cycles returned to Cycle Wholesaling one-quarter of the merchandise from February 1 cost of goods returned was 80. Sales price per unit- total job cost per unitgross profit per unit 850-296554. Prepare a job cost sheet for Job 201 and for Job 202 for the month.

Gross Profit Revenue - Cost of Goods Sold Gross Profit 1200 - 320 Gross Profit 880 Using the above gross profit formula you would make 880 in gross profit daily. Prepare a job cost sheet for Job 201 and for Job 202 for the month. Gross profit Sales Gross profit margin You could also subtract the COGS from the revenue divide that by the total revenue and multiply it all by 100.

However if the cost of sales of your business is in excess of sales revenue it results in Gross Loss for your business. Revenue from Operations ie Net Sales 400000. 625 If you sell 10 units you would make.

If you sell 1 unit you would make. Your profit is 20. Solve Study Textbooks Guides.

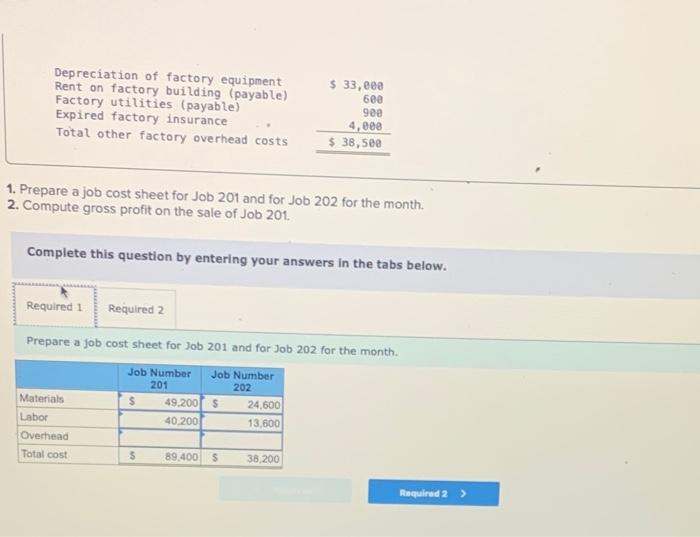

Materials Labor Overhead Total cost Job Number 201 49200 40200 Job. 1250 If you sell 25 units you would make. Job 201 Cost of goods sold Sales 187880 Gross Profit.

Gross Profit Margin 850000 - 650000850000 x 100. Compute Gross Profit Ratio from the following information. Compute gross profit on the sale of Job 201.

To recap this is the percentage of revenues that remain after deducting cost of goods sold. Alton Foundry uses a predetermined manufacturing overhead rate to allocate overhead to individual jobs based on the machine hours required. 200000 Gross Profit is 25 on cost.

201 Qs Hard Questions. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80 of direct materials cost. Prepare a job cost sheet for Job 201 and for Job 202 for the month.

Required 1 Required 2 Prepare a job cost sheet for Job 201 and for Job 202 for the month. Gross Profit Margin 714 Gross Profit per Product 125. It shows up the broad features of trading operation in their essence.

The gross profit margin for Garrys Glasses is 24. Gross Profit x 100Sales is a significant figure. Lets look at the gross profit of ABC Clothing Inc.

Complete this question by entering your answers in the tabs below. The accounting department is responsible to record all manufacturing costs direct materials direct labor and manufacturing overhead on the job cost sheetA separate job cost. The ratio of gross profit to sales ie.

Join Login Class 10. Complete this question by entering your answers in the tabs below. As an example of the computation of gross profit margin.

Prepare a job cost sheet for Job 201 and for Job 202 for the month. Cost of goods sold sales 100gross profit 25 Cost of goods sold 10025125 Cost of goods sold 500000125100400000 201 views Answer requested by Muhammad Ali Promoted by The Penny Hoarder What are the biggest money secrets that rich people keep from us. 3125 If you sell 50 units you would make.

Gross profit for the sale of Job 201 38140 168860 - 130720 Data and Calculations. Job Number Job Number 201 202 Materials Labor Overhead Total cost S 0 S 0. 9375 If you sell 100 units you would make.

Required 1 Required 2 Prepare a job cost sheet for Job 201 and for Job 202 for the month. 125 If you sell 5 units you would make. 12 Qs CLASSES AND TRENDING CHAPTER.

Advertisement Remove all ads. Compute gross profit on the sale of Job 201. For Year One sales were 1 million and the gross profit was 250000 -- resulting in.

Complete this question by entering your answers in the tabs below.

Solved Required Information The Following Information Chegg Com

Solved Information On Kwon Manufacturing S Activities For Chegg Com

Solved Information On Kwon Manufacturing S Activities For Chegg Com

0 Comments